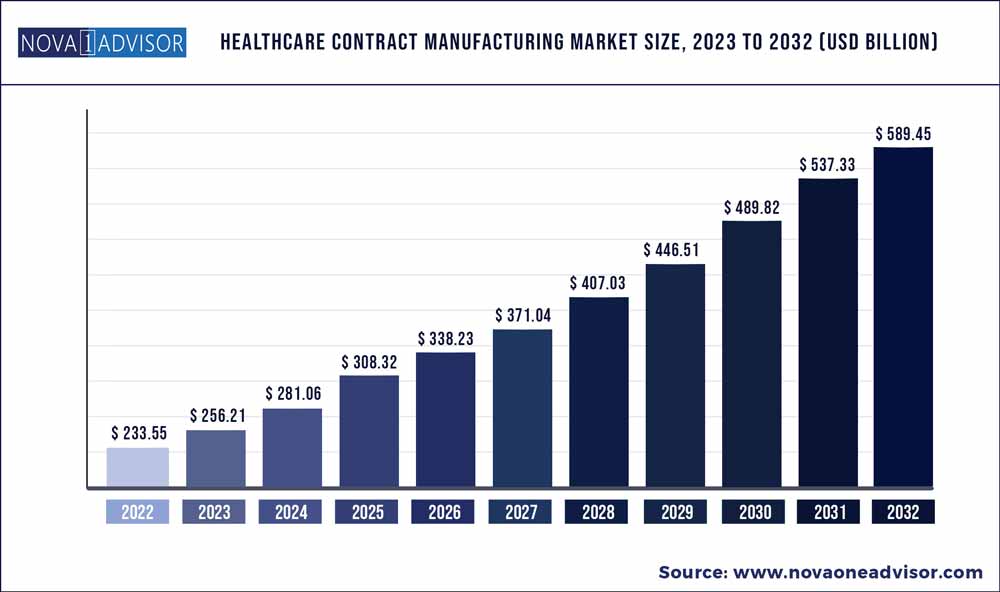

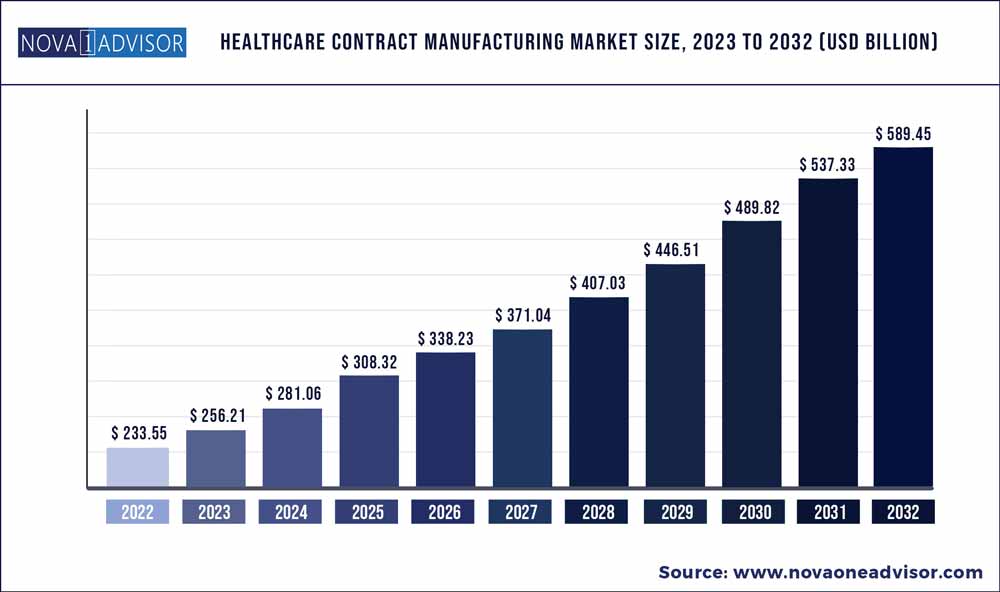

The global healthcare contract manufacturing market size was exhibited at USD 233.55 billion in 2022 and is projected to hit around USD 589.45 billion by 2032, growing at a CAGR of 9.7% during the forecast period 2023 to 2032.

Key Pointers:

- The pharmaceutical segment dominated the market with a share of 75.9% in 2022 owing to a low manufacturing budget and highly sophisticated contract manufacturing service offerings.

- The medical devices segment is expected to be the fastest-growing segment with a CAGR of 11.7% owing to increasing pressure on OEMs to reduce costs and enhance the timeline for taking a product to market.

- Cardiology is the dominant segment in the medical device contract manufacturing market owing to the rising demand for cardiovascular devices as a result of the increasing prevalence of associated heart conditions.

- Asia Pacific is the dominant region with a share of 46.8% in 2022 and is expected to witness lucrative growth owing to the presence of a large number of service providers, lower costs and growing demand for medical devices in the region.

Healthcare Contract Manufacturing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 256.21 Billion

|

|

Market Size by 2032

|

USD 589.45 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 9.7%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Type, end-use

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Nordson Corporation; Integer Holdings Corporation; Jabil Inc.; Viant Technology LLC; FLEX LTD.; Celestica Inc.; Sanmina Corporation; Plexus Corp.; Phillips-Medisize; West Pharmaceutical Services, Inc.; Synecco; Catalent, Inc.; Thermo Fisher Scientific Inc.; Recipharm; Boehringer Ingelheim International GmbH; Lonza; Samsung Biologics; WuXi AppTec; FUJIFILM Diosynth Biotechnologies; Cambrex Corporation

|

The increase in offshoring, especially in emerging countries, and the changing regulatory landscape, are the prominent trends currently present in the market. Pharmaceutical and medical device companies are outsourcing low-end services to third parties (CMOs) to reduce the overall cost of production and speed up the time to market of products. This trend is expected to contribute to the growth of the contract manufacturing market in the foreseeable future. COVID-19 brought in unparalleled demand for diagnostic tests, Personal Protective Equipment (PPE), ventilators, and other critical medical supplies. COVID-19 has had a major impact on the supply-demand gap, with a 1,000 to 2,000-fold increase for PPE products, raw material shortages increased by over 10% thereby pushing the by more than 100% in 2020.

The COVID-19 pandemic has forced many pharmaceutical and medical device companies to increase the manufacturing of drugs and medical devices needed by infected patients worldwide. The U.S. FDA has observed that over 60% of FDA-regulated products imported from China are medical devices, making U.S. medical device industry highly dependent on China’s supply chain. Medical device manufacturers are facing severe supply bottlenecks, which will ultimately reduce the company’s scope of revenue generation.

The presence of end-to-end service providers that are engaged in providing value-added services for an integrated or risk-sharing business model is expected to boost the market growth. Pharmaceutical and medical device companies are outsourcing manufacturing activities to CMOs to reduce their manufacturing footprint. It allows manufacturers to be more dynamic and cost-effective in their manufacturing process.

In addition, factors such as the increasing prevalence of noninvasive surgical procedures are driving the demand for pharmaceutical drugs and medical devices. To meet such increased demand, OEMs are outsourcing the manufacturing of non-core manufacturing activities as it assists them in reducing labor costs, freeing up capital, increasing worker productivity, and improving manufacturing lead times. For many large, medium and small pharma firms, outsourcing turns out to be an economic option, as fixed costs for manufacturing biologics products account for around 60–70% of the Cost of goods sold (COGS) and cannot be avoided even during idle conditions.

Therefore, the use of multi-product facilities to produce biologics has been proven economically efficient and safe as there is negligible to no risk with respect to product carryover, thereby supporting market growth. Since the medical device industry is highly regulated, making rapid changes in the supply chain may not be manageable. Medical device manufacturers distributing products in the U.S. are not required to report actual or potential supply chain shortages to the FDA. Despite this, the FDA is actively addressing potential shortages in the medical device supply chain. Some of the products facing shortage are aluminum products, integrated circuits, lithium-ion batteries, and special components, including pneumatic fittings, black body radiation source, & platinum.

This has created an unprecedented demand for the manufacturing of active pharmaceutical ingredients (APIs), finished doses, and medical devices in order to maintain supply. According to Medical Product Outsourcing, manufacturers expect outsourcing to yield cost savings and faster time to market. According to various reputed tabloids, companies are expected to outsource more work, based on a 2020 Global Managed Services Report. This report has performed a survey with 1,250 executives across 29 countries, which stated that 45% of organizations will outsource more in the coming years. However, the limited production capacity of CMOs may pose a major challenge restraining the market growth.

Some of the prominent players in the Healthcare Contract Manufacturing Market include:

- Nordson Corporation

- Integer Holdings Corporation

- Jabil Inc.

- Viant Technology LLC

- FLEX LTD.

- Celestica Inc.

- Sanmina Corporation

- Plexus Corp.

- Phillips-Medisize

- West Pharmaceutical Services, Inc.

- Synecco

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Recipharm

- Boehringer Ingelheim International GmbH

- Lonza

- Samsung Biologics

- WuXi AppTec

- FUJIFILM Diosynth Biotechnologies

- Cambrex Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Healthcare Contract Manufacturing market.

By Type

- Medical Device

- By Service

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- By Therapeutic Area

- Cardiology

- Diagnostic imaging

- Orthopedic

- IVD

- Ophthalmic

- General & plastic surgery

- Drug delivery

- Dental

- Endoscopy

- Diabetes care

- Others

- Pharmaceutical

- By Service

- API/Bulk Drugs

- Advanced Drug Delivery Formulations

- Packaging

- Finished Dose Formulations

- Solid

- Liquid

- Semi-solid formulations

By End use

- Medical Device Companies

- Pharmaceutical Companies

- Biopharmaceutical Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)